FinTech News

BNPL 3.0 – What’s Next? Responsible Lending, Regulation, and the Rise of B2B BNPL

BNPL 3.0 marks the next evolution of Buy Now, Pay Later, focusing on responsible lending, regulatory compliance, and the rise of B2B BNPL. As concerns about consumer debt and transparency grow, BNPL platforms are adopting smarter credit checks, financial literacy tools, and AI-powered risk assessments.

4 minute read

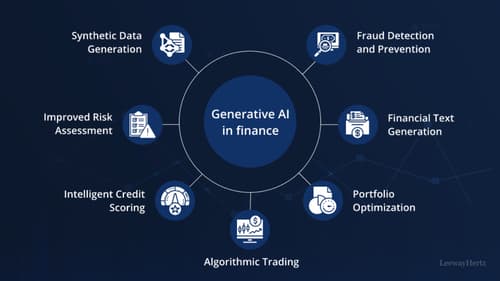

Synthetic Data in Fintech Enhancing Data Privacy and Training AI Models Without Compromising Real User Data

Synthetic data is revolutionizing the fintech industry by enabling the safe development of AI models without using real user data. It mimics real financial data while preserving privacy, making it ideal for training AI, testing products, and ensuring regulatory compliance.

4 minute read

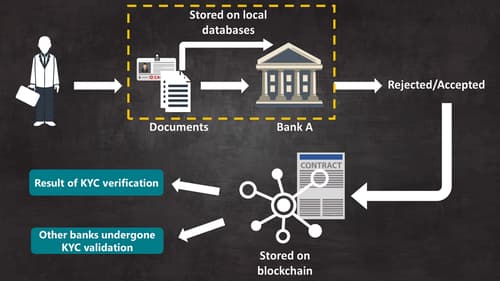

Blockchain for KYC & AML Compliance A Shared Ledger Approach

Blockchain technology is revolutionizing KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance by offering a shared, tamper-proof ledger for secure and efficient identity verification. Instead of duplicating efforts across institutions, verified customer data can be reused with permission, reducing costs, speeding up onboarding, and improving security

3 minute read

Voice Biometrics in Banking The Next Step in Seamless Customer Authentication

Voice biometrics is revolutionizing banking by using unique voice patterns to securely and seamlessly authenticate customers. This technology enhances security by reducing fraud risk, speeds up customer interactions by eliminating passwords, and cuts operational costs for banks.

4 minute read

From QR Codes to Voice Payments: The Future of Contactless Transactions

The future of contactless transactions is rapidly evolving from simple QR code scans to advanced voice-activated payments. While QR codes offer affordability and ease, especially in markets like India, voice payments bring hands-free convenience powered by AI and smart assistants

3 minute read